will child tax credit payments continue in january 2022

No monthly CTC. Each taxpayer received 250 or 300 per child.

Child Tax Credit 2022 Will Ctc Payments Finally Be Extended Marca

But others are still pushing for.

. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. However for 2022 the credit has reverted back to 2000 per child with no monthly payments. ANY hope of receiving a child tax credit payment in January 2022 is slowly slipping away as Congress holds the key to more money for Americans.

Increasing the maximum credit that households can claim to 3600 per child age 5 or younger and 3000 per child ages 6 to 17. Will child tax credits continue beyond 2022. The letters will continue being sent out into January.

If nothing is done to extend child tax credits at the current amount CTCs will return to a 2000 lump sum for individuals making up to 200000. FAMILIES have grown used to monthly 300 payments through the expanded child tax credit but in February 2022 theres a chance the long-awaited extension could double payments. Many people are concerned about how parents.

This credit begins to phase down to 2000 per child once. What we do know is that the final payment from the 2021 tax year is still to come in April 2022. If you opted out of partial payments before the first check went out youll get your full eligible amount with your tax refund -- up to 3600 per.

The law authorizing last years monthly payments clearly states that no payments can be made after December 31 2021. But the changes they may make. The last round of monthly child tax credit payments will arrive in bank accounts on dec.

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Families who received advance payments will need to file a 2021 tax return and compare the advance child tax credit payments they received in 2021 with the amount of the CTC they can properly claim on their 2021 tax return. 2022 changes to child tax credit in 2022 the monthly payments would continue but this time would stretch throughout the full calendar year with 12 monthly payments with maximums remaining the same.

Making the credit fully refundable. As it stands right now child tax credit payments wont be renewed this year. The money will come at one time when 2022 taxes are filed in the spring of 2023.

As it stands right now child tax credit payments wont be renewed this year. The Senate isnt expected to vote on the Build Back Better Act until 2022 making it unlikely that people will receive another child tax credit payment in January. Is the child tax credit going to be extended.

The law authorizing last years monthly payments clearly states that no payments can be made after December 31 2021. Letter 6419 includes the total amount of advance child tax credit payments. The payment amount is related to the age of the qualifying child youre anticipating to claim the child tax credit.

Without legislative changes the CTC in 2022 will revert to its prior form a 2000 tax credit taken annually versus the expanded CTCs credit of. For couples filing jointly who make up to 400000 the amount is 1400. Washington lawmakers may still revisit expanding the child tax credit.

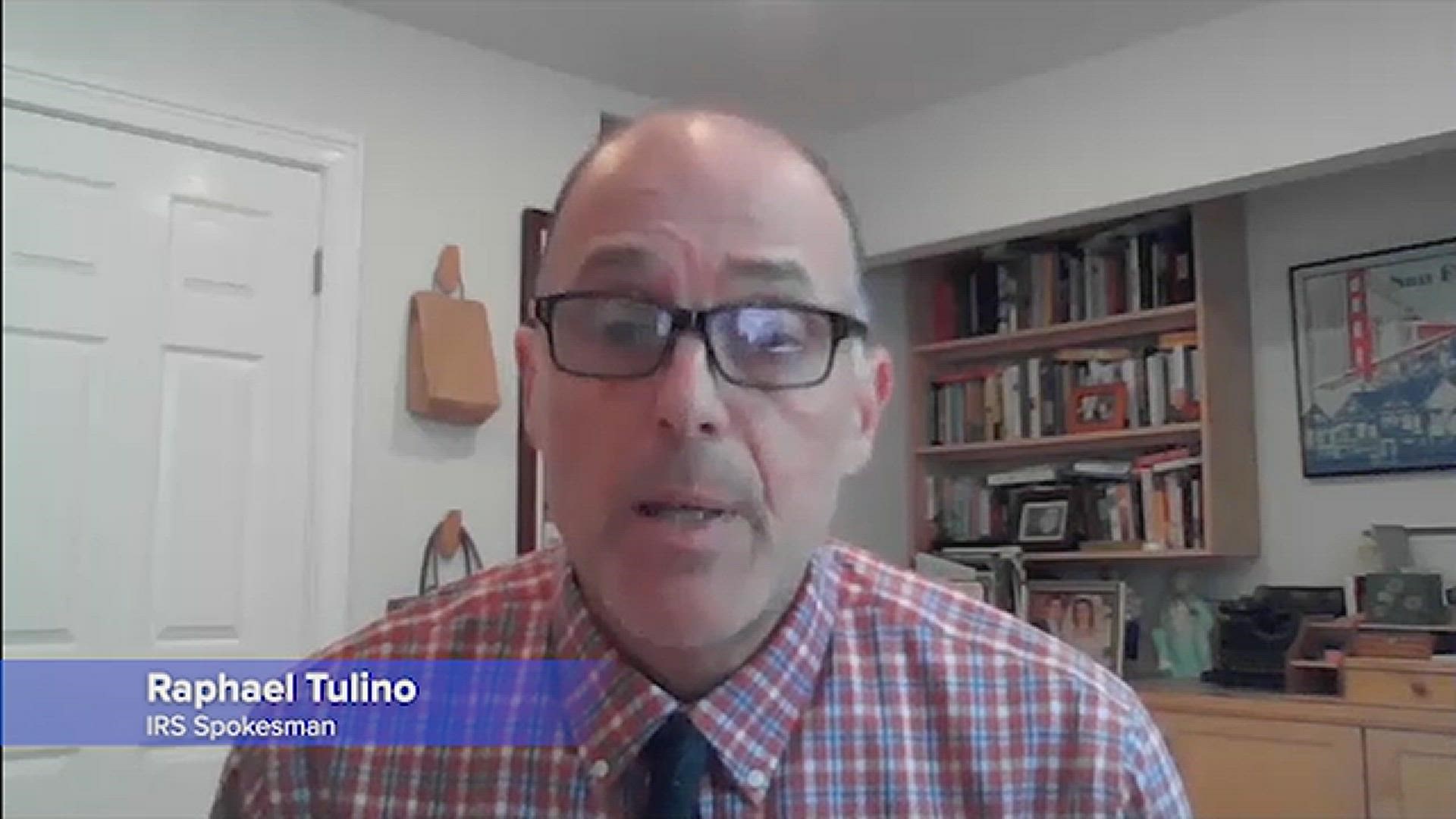

In January 2022 the IRS will send Letter 6419 with the total amount of advance child tax credit payments taxpayers received in 2021. As such the future of the Child Tax Credit advance payments scheme remains unknown. For families who collected all of the advance child tax credit payments that means the remaining 1800 credit will apply when they file taxes next year.

The Build Back Better Act stalled in the Senate and now Congress is on holiday. This amount is increased to 300 per child under 6. Now even before those monthly child tax credit advances run out the final two payments come on Nov.

For the first time since July families are not expected to receive a 300 payment on January 15 2022. However Congress had to vote to extend the payments past 2021. Congress fails to renew the advance Child Tax Credit payments which would have been part of the Build Back Better Act and the payments expire.

No monthly payments will be sent from IRS in January 2022 for the first time in months because the credit expired. Most recently lawmakers proposed extending the child tax credit to just one year in an effort to trim the cost of President Joe Bidens 35 trillion plan. The benefit for the 2021 year is 3000 and 3600 for children under the age of 6.

Therefore child tax credit payments will NOT continue in 2022. For children between 6 and 18 the child credit is 250 on a monthly basis. 15 Democratic leaders in Congress are working to extend the benefit into 2022.

The reason for this is that while the child tax.

Fourth Stimulus Check 8 000 Child Tax Credit Medicare Cola 2022 Benefits Summary 1 January As Com

Families Face First Month Without Child Tax Credit Payments Since July Cronkite News Arizona Pbs

Child Tax Credit Will Monthly Payments Continue In 2022 Abc10 Com

Child Tax Credit Parents Struggle And Poverty Expected To Rise As Enhanced Benefits End Cnn Politics

What Families Need To Know About The Ctc In 2022 Clasp

No More Monthly Child Tax Credits Now What

Will Monthly Child Tax Credit Payments Be Renewed Forbes Advisor

Child Tax Credit Will Monthly Payments Continue Into 2022 Gobankingrates

First Month Without The Expanded Child Tax Credit Has Left Families In Distress Npr

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Child Tax Credit 2022 How To Claim A Missed Payment Before Tax Deadline Marca

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Here S What Has To Happen For Child Tax Credit Payments To Continue In 2022 Wjhl Tri Cities News Weather

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

If You Got The Child Tax Credit In 2021 You May Pay In 2022 Wsj

Child Tax Credit Children 18 And Older Not Eligible 13newsnow Com

Will Monthly Child Tax Credit Payments Be Renewed In 2022 Kiplinger

The Monthly Child Tax Credit Payments Are Done Here S What Will Replace It Fortune